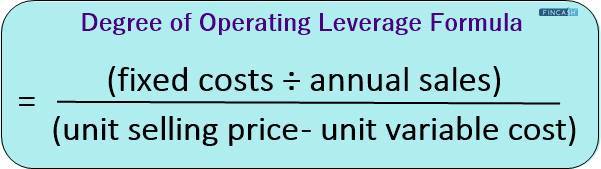

We will also see the calculation of the degree of operating leverage for an alternative formula considered an ideal calculation method. Yes, DOL can be used to compare the operational risk of companies within the same industry, helping investors identify firms with higher or lower financial risk profiles. If you have the percentual change (period to period) of sales, put it here. Otherwise, add the specific period data in the section “Period to period specific data” above. The operating margin in the base case is 50%, as calculated earlier, and the benefits of high DOL can be seen in the upside case.

Analysis and Interpretation

Most of a company’s costs are fixed costs that recur each month, such as rent, regardless of sales volume. As long as a business earns a substantial profit on each sale and sustains adequate sales volume, fixed costs are covered, and profits are earned. The higher the degree of operating leverage (DOL), the more sensitive a company’s earnings before interest and taxes (EBIT) are to changes in sales, assuming all other variables remain constant. The DOL ratio helps analysts determine what the impact of any change in sales will be on the company’s earnings. John’s Software is a leading software business, which mostly incurs fixed costs for upfront development and marketing. John’s fixed costs are $780,000, which goes towards developers’ salaries and the cost per unit is $0.08.

Return on Investment (ROI): Definition, Usage, Formula, and Example

A company with low operating leverage has a large proportion of variable costs—which means that it earns a smaller profit on each sale, but does not have to increase sales as much to cover its lower fixed costs. If fixed costs are high, a company will find it difficult to manage short-term revenue fluctuation, because expenses are incurred regardless of sales levels. This increases risk and typically creates a lack of flexibility that hurts the bottom line. Companies with high risk and high degrees of operating leverage find it harder to obtain cheap financing.

Would you prefer to work with a financial professional remotely or in-person?

The setting up a mobile office for your business shows the change in operating income to the change in the revenues or sales of a company. The more fixed costs there are, the more sales a company must generate in order to reach its break-even point, which is when a company’s revenue is equivalent to the sum of its total costs. If a company expects an increase in sales, a high degree of operating leverage will lead to a corresponding operating income increase. But if a company is expecting a sales decrease, a high degree of operating leverage will lead to an operating income decrease. Operating income is equal to sales minus variable costs and fixed costs.

It simply indicates that variable costs are the majority of the costs a business pays. While the company will earn less profit for each additional unit of a product it sells, a slowdown in sales will be less problematic becuase the company has low fixed costs. The contribution margin represents the percentage of revenue remaining after deducting just the variable costs, while the operating margin is the percentage of revenue left after subtracting out both variable and fixed costs.

For example, airlines have high operating leverage because the cost of carrying an additional passenger on a plane is quite low. Much of the price of a restaurant meal is in the ingredients and labor, meaning they’ll have low operating leverage. During the 1990s, investors marveled at the nature of its software business. The company spent tens of millions of dollars to develop each of its digital delivery and storage software programs. But thanks to the internet, Inktomi’s software could be distributed to customers at almost no cost. After its fixed development costs were recovered, each additional sale was almost pure profit.

The revenues of company XYZ are $ 58.6 million, and that of company LMN are $ 32.7 million. The variable costs of company XYZ and company LMN are $25.7 million and $14.56 million. Similarly, the fixed costs of company XYZ and company LMN are $10.9 million and $6.54 million.

- In this article, we’ll give you a detailed guide to understanding operating leverage.

- This structure provides stability, as lower fixed costs mean the company doesn’t require high sales volumes to cover its expenses.

- In fact, the relationship between sales revenue and EBIT is referred to as operating leverage because when the sales level increases or decreases, EBIT also changes.

On the other hand, if a company has low operating leverage, then it means that variable costs contribute a large proportion of its overall cost structure. Such a company does not need to increase sales per se to cover its lower fixed costs, but it earns a smaller profit on each incremental sale. The bulk of this company’s cost structure is fixed and limited to upfront development and marketing costs. Whether it sells one copy or 10 million copies of its latest Windows software, Microsoft’s costs remain basically unchanged. So, once the company has sold enough copies to cover its fixed costs, every additional dollar of sales revenue drops into the bottom line.

The degree of operating leverage can show you the impact of operating leverage on the firm’s earnings before interest and taxes (EBIT). Also, the DOL is important if you want to assess the effect of fixed costs and variable costs of the core operations of your business. By breaking down the equation, you can see that DOL is expressed by the relationship between quantity, price and variable cost per unit to fixed costs. If operating income is sensitive to changes in the pricing structure and sales, the firm is expected to generate a high DOL and vice versa. This is actually caused by the “amplifying effect” of using fixed costs.

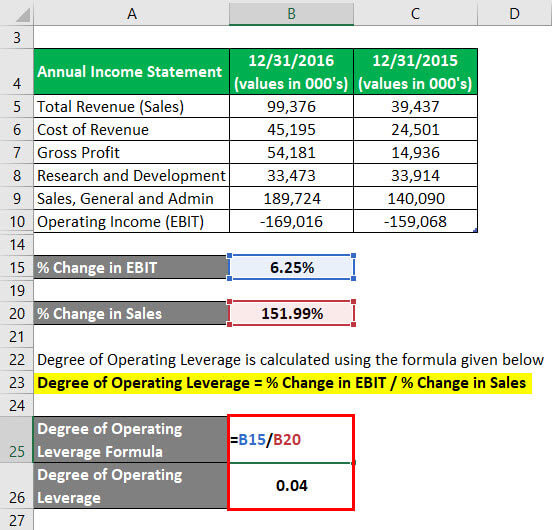

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. The degree of combined leverage gives any business the optimal level of DOL and DOF. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. These calculators are important because as critical as it is to know how the business is doing, the price you are paying for a part of the company is also important. We will need to get the EBIT and the USD sales for the two consecutive periods we want to analyze.

The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales. It provides insight into the relationship between fixed and variable costs and their impact on profitability. High DOL indicates that a small percentage change in sales can lead to a significant change in operating income. By contrast, a retailer such as Walmart demonstrates relatively low operating leverage. The company has fairly low levels of fixed costs, while its variable costs are large.