Operating leverage is the ratio of a business’s fixed costs to its variable costs. This ratio is often used when forecasting sales and determining appropriate prices. As can be seen from the example, the company’s degree of operating leverage is 1.0x for both years. As a business owner or manager, it is important to be aware of the company’s cost structure and how changes in revenue will impact earnings. Additionally, investors should also keep an eye on this ratio when considering an investment in a company. Financial leverage is a more relative measure of the company’s debt for acquiring the fixed assets to use.

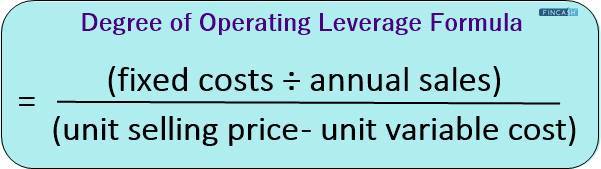

How to Calculate Operating Leverage

There are many alternative ways of calculating the degree of operating leverage. Operating leverage is the most authentic way of analyzing the cost structure of any business. The only difference now is that the number of units sold is 5mm higher in the upside case and 5mm lower in the downside case. Companies with high DOLs have the potential to earn more profits on each incremental sale as the business scales.

Degree Of Operating Leverage: Explanation, Formula, Example, and More

By analyzing DOL, stakeholders can better anticipate the impacts of sales fluctuations on a company’s profitability. We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio. For illustration, let’s say a software company has invested $10 million into development and marketing for its latest application program, which sells for $45 per copy. Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range.

- If revenue increased, the benefit to operating margin would be greater, but if it were to decrease, the margins of the company could potentially face significant downward pressure.

- As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two.

- Another way to control this operational expense line item is to reduce unnecessary expenses, especially during slow seasons when sales are low.

- It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others.

Degree of Operating Leverage: Definition, Formula & Calculation

A 20% increase in sales will result in a 60% increase in operating income. Consequently it also applies to decreases, e.g., a 15% decrease in sales would result to a 45% decrease in operating income. In contrast, a company with relatively low degrees of operating leverage has mild changes when sales revenue fluctuates. Companies with high degrees of operating leverage experience more significant changes in profit when revenues change.

Not all corporations use both operating and financial leverage, but this formula can be used if they do. A firm with a relatively high level of combined leverage is seen as riskier than a firm with less combined leverage because high leverage means more fixed costs to the firm. This ratio helps managers and investors alike to identify how a company’s cost structure will affect earnings. The degree of combined leverage measures the cumulative effect of operating leverage and financial leverage on the earnings per share. The impact of the high fixed costs is directly seen in the firm’s ability to manage revenue fluctuations.

How to Calculate Earnings Per Share? (Definition, Using, Formula)

Companies with high fixed costs relative to variable costs will exhibit high operating leverage, meaning their earnings are more volatile with changes in sales. This can be beneficial in periods of rising sales but risky when sales decline. That indicates to us that this company might have huge variable costs relative to its sales. Similarly, we can conclude the same by realizing how little the operating leverage ratio is, at only 0.02.

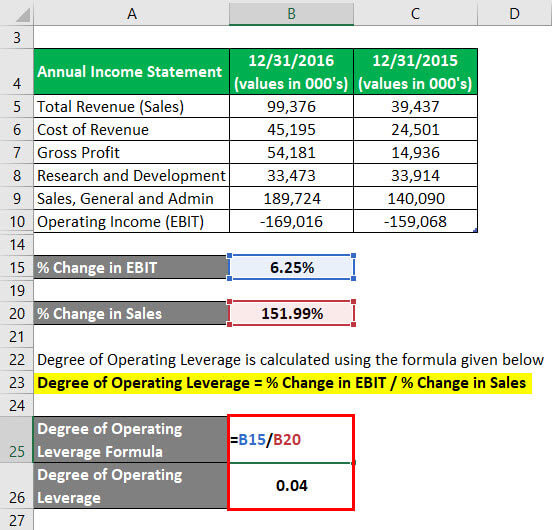

An operating leverage under 1 means that a company pays more in variable costs than it earns from each sale. Companies facing this will need to raise prices or work to reduce variable costs to bring operating leverage above 1. Looking back at a company’s income statements, investors can calculate changes in operating profit and sales. Investors can use the change in EBIT divided by the change in sales revenue to estimate what the value of DOL might be for different levels of sales.

In other words, there are some costs that have to be paid even if the company has no sales. These types of expenses are called fixed costs, and this is where Operating Leverage comes from. As it pertains to small businesses, it refers to the degree of increase in costs relative to the degree of increase in sales.

Without a good understanding of the company’s inner workings, it is difficult to get a truly accurate measure of the DOL. The high leverage involved in counting on sales to repay fixed costs can put companies and their shareholders at risk. High operating leverage during a downturn can be an Achilles heel, putting pressure on profit margins and making a contraction in earnings unavoidable. Indeed, companies such as Inktomi, with high operating leverage, typically have larger volatility in their operating earnings and share prices. While this is riskier, it does mean that every sale made after the break-even point will generate a higher contribution to profit.

Since profits increase with volume, returns tend to be higher if volume is increased. The challenge that this type of business structure presents is that it also means that there will be serious declines in earnings if sales use account numbers in your chart of accounts in quickbooks online fall off. This does not only impact current Cash Flow, but it may also affect future Cash Flow as well. However, if the company’s expected sales are 240 units, then the change from this level would have a DOL of 3.27 times.